Transitioning successfully to omni-channel distribution is challenging. Not only are there more channels than ever to manage, but the lines between the channels are blurring. When designing omni-channel fulfilment operations, there are a lot of levers that have to be in alignment. So how do you design your DC with the flexibility to handle an unpredictable future AND that minimizes your cost-to-serve?

Follow these 5 steps. And a hint: It’s all about the data.

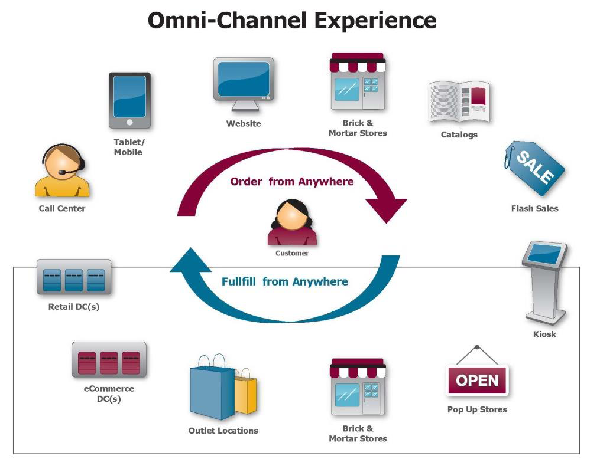

The Omni-Channel Experience

Customers are looking for a “seamless” omni-channel shopping experience. They want to:

· Buy online, and pick it up in the store

· Try it on in the store and get it delivered at home if the colour they want is out of stock in the local store.

· Place an order on a mobile device and be assured that the item is not only available, but also be able to choose how much to pay for shipping and know exactly when it will be delivered.

· Order online, have it delivered at home and return to the store if it doesn’t fit.

The Bottom Line: the customer wants what they want, when they want it, where they want it and at the price they want it. And if you don’t have it, you better get it to their house tomorrow, or they’ll buy it from Amazon who will—with free shipping.

And then there’s Amazon. They continue to change the rules of the game and influence customers’ expectations with their ever-increasing service enhancements. The number of customers willing to pay for “same-day delivery” may be fairly low, but that Amazon makes the offer has shifted the bar yet again.

Buy Anywhere - YES, but Fulfil from Anywhere?

And it’s about to get even more complicated. While your customers are demanding a seamless omni-channel shopping experience where they can “order from anywhere,” leading retailers are moving to a “fulfil from anywhere” model, too.

· Best Buy has kiosks in hotels and airports where you can purchase a camera or camcorder on the spot. You‘ll see more of this as retailers seek to put their product into the hands of consumers in a way that is most convenient for the customer.

· Macy’s is making over 400 of their stores into distribution nodes in a “ship from store” model. Since forecasting is never 100% accurate, this model helps them meet unpredictable demand by leveraging their full inventory, no matter where it sits.

Designing DCs for Omni-Channel Fulfilment

How do you design your distribution centre to include flexible fulfilment paths to meet demand, regardless of which channel it comes from? And how can you do that while minimizing your cost-to-serve? Your business is trying to accomplish specific goals and has unique requirements and order profiles. So to get to the right answer, you need to let your unique data guide you to the right answer for your business. Someone else’s DC design will not do.

Although every company is unique, there is a common methodology for getting to the best fulfilment strategy for omni-channel distribution. The “secret sauce” is a five-step process that revolves around your data and gets into deeper levels of analysis as you go through the steps:

1. Evaluate Synergies Across Channels

2. Find the Best Operating Methods

3. Choose Technologies/Processes for Each Operating Method

4. Define Optimal Flow Paths

5. Choose Specific Technologies

Step 1: Evaluate Synergies Across Channels

The first step in designing omni-channel fulfilment operations is to look for similarities across your channels in each of these areas:

· Cycle Time

· Product Packaging

· Inventory Sharing

· Outbound Packaging

· Receiving/Cross-dock

· Put Away & Storage

· Order Profiles

· Fixed SKUs vs. Fixed Orders

· Picking Methodology

· VAS/Packing

· Shipping/Carrier

Step 2: Find the Best Operating Methods

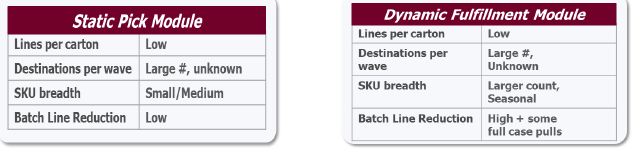

Once you know where your synergies are, the next step is to dig deeper into your order profiles to find the best operating methods. For example, do you need a static module or dynamic pick locations for picking? When one large retailer analysed their SKU velocity, they found a set of SKUs that were consistently fast movers throughout the year. For these SKUs, it made sense to use a static module for high pick productivity. But for the rest of their slower-moving SKUs, a dynamic pick area with advanced slotting logic was the best answer. Their WMS system dynamically brings these items forward as needed to balance pick productivity with space utilization.

Step 3: Choose Technologies/Processes for Each Operating Method

Once you’ve analysed your order profiles and chosen the best operating methods, the next step is to choose the best technology/process for each operating method. And there are a lot of functions in a distribution centre requiring these decisions:

· Receiving

· Picking Method

· Full Case Picking

· Less-Than-Case Picking

· Replenishment

· Buffer/Stage

· Packing

· Shipping/Outbound

This step is all about evaluating and finding the most financially justified technologies/ processes, and asking “Will the gains from using a certain solution justify the investment?” Don’t make the mistake of allowing this step to be driven by a pre-conceived “right answer”; everything looks like a nail if you have a hammer. This step should only be done with a technology and vendor agnostic approach.

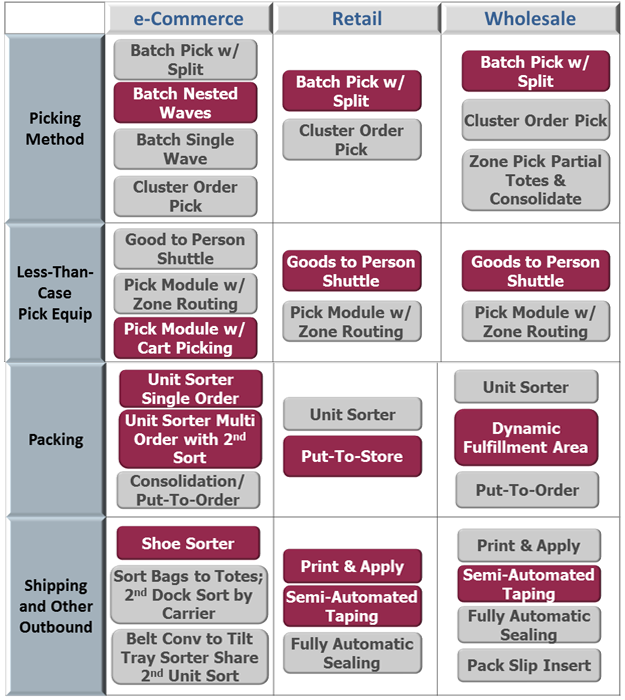

To start, develop a chart, like the one above, with functions that need technology and process decisions down the rows—and the channels as columns. Then identify the potential solution for each function. With this client we found:

Batch picking was the best picking method. But that can be done in a number of ways -- single waves, two waves at once, or even a cluster order pick. Ultimately, the right answer was to batch pick with multiple packing waves active at the same time.

It made sense to use a static pick module for eCommerce, while Retail and Wholesale required a dynamic Goods-to-Person solution.

And in the row labelled “Shipping and Other Outbound” you can see that this client was able to share semi-automated taping between Retail and Wholesale. So they set up a line of packing, taping and print & apply that could serve both channels.

Step 4: Define Optimal Flow Paths

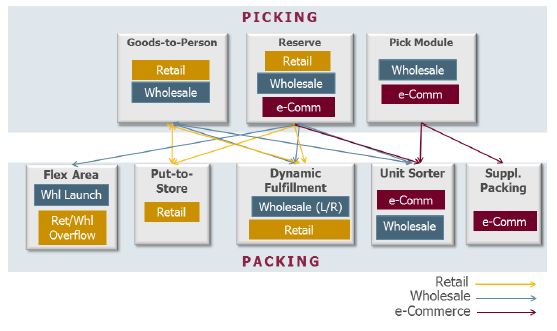

Once you’ve figured out what technology to apply to each function, you can turn to identifying and sizing your fulfilment engines. Here, you’ll look for synergies between flow paths, too. In the example below, the Goods-to-Person technology can be applied to Retail and Wholesale orders, but for sortation and packing, eCommerce and certain Wholesale orders can share the unit sorter.

The graphic shows common flows and connection points between picking and packing. By assigning volumes to each arrow you can begin to define conveyor rates and product handling requirements (carton, tote, bag, unit) in order to avoid future bottlenecks. This approach provides the ability to re-purpose a fulfilment engine, active pick area or reserve storage from one channel to the other. While having one or two fulfilment engines may be simpler from an operational and waving complexity standpoint, having three or four fulfilment engines accommodates multiple order profiles AND is more likely to sustain larger swings in channel forecasts. For example, if unexpected growth occurs in one flow path you could potentially shift some volume to an alternate flow path.

And don’t forget to include a flex area in your design. Most omni-channel fulfilment centres need a flexible area to deal with the changes in mix across order profiles on any given day. A large sporting goods retailer found that their order mix across channels and order profiles changed as much as 80% per day. So each flow path had to be sized to handle 80% of the total daily volume. This required additional investment but provided the flexibility needed to support the dynamics of the business.

This is also where you want to start to address peak season and cut-off times. For one client, shifting order cut-off from 10:00 AM to noon had very little impact, but pushing that cut-off time to 2pm would have cost them millions in more expensive technology.

Step 5: Choose Specific Technologies

The last step is to identify the very specific technology that is best for each function in the DC. For example, you can pick by paper, by RF, by voice or by light. And sorters come in a variety of types (cross-belt, tilt tray, bomb bay, shoe, etc.) And goods-to-person technologies vary as well (carousel, AS/RS, etc.)

When evaluating and choosing the specific technology, look for the best balance between performance, flexibility and cost. And consider how the requirement might vary between daily and peak operations, when you may have an influx of seasonal workers to train.

The good news is that justifying an investment in automation is one of the few things that have gotten easier in recent years. With new competitors promising next day or same-day delivery, automation is now being justified by service improvements, not just on labour savings. Companies are asking, “What is the value of moving order cut-off time one hour later?” and “What is the value of getting 1% closer to the perfect order?” Automation is much more easily justified when it positively impacts sales.

Omni-Channel Fulfillment is Bigger than Distribution

The impacts of today’s “order from anywhere - fulfill from anywhere” environment go far beyond the four walls of your distribution center. In essence, it requires a more integrated, holistic strategy across channel owners, merchandising, store operations and distribution operations, among others. It requires changes to:

· Planning

· Business Processes

· Systems

· Culture

· Metrics and Incentives

In short, omni-channel distribution is driving companies to think differently about their entire businesses. For example:

· If one channel is out-of-stock, when should you borrow from another channel? What if that other channel has an urgent order pending?

· Can you postpone product packaging so you can share inventory that is normally packaged by channel (in a box, poly-bagged and on a hanger)?

· Are your information systems set up for inventory sharing?

· If you combine the volume from two channels, could you get transportation savings? For example, zone skipping.

· If a store associate places an online order for a customer, which channel gets credit for the sale?

· Are you aligned across a broader set of stakeholders? And does that include metrics and incentives to encourage that alignment?

Contributed by: Fortna