A

growing number of organisations have recognised the increasingly uncertain risk

picture that results from relationships with third parties. There appears,

however, to be much disagreement about how to effectively identify, quantify,

and mitigate such risks.

Service-provider risk management

In a recent study conducted by ChainLink Research, nearly 50% of organisations indicated that risk assessment played a “critical and mandatory” role in their service provider selection. However, more than 70% of the surveyed organisations reported having no resilience and risk-mitigation standards to which they hold their service providers accountable.

Furthermore, the ChainLink research noted that “the thoroughness of the risk

assessment varies greatly, depending on the company”. Companies lack the

ability to extend risk assessment to subcontractors and tend to focus on the

easiest risks to quantify, such as financial viability or business-continuity

plans.

Supply-side partner risk management

In another study, by Compliance Week magazine, more than 90% of the surveyed

corporate executives said they believe conducting a vendor-risk assessment is

either important or very important. At the same time, though, more than half

were dissatisfied or at best had neutral feelings about their company’s current

approach to vendor-risk assessments. As Compliance Week summarised:

“Vendor-risk assessments continue to confound many companies, even while they

say that getting a handle on supply-chain risk is at the top of their priority

list.”

The top difficulties cited by the survey respondents included a lack of good

data on vendors, poor visibility into the use of subcontractors, and

limitations in comparing vendor risks.

Types of third-party risk relationships:

Demand-side partner risk

management

Demand-side third-party relationship risk tends to be industry-specific, and

varies depending on the method of delivery to customers (direct or

multichannel, for example). Often companies lack the infrastructure or

technology to have adequate monitoring in place and handle the volume of

demand-side relationships. It is common for companies to rely solely on the

self-reporting of information.

Risk management of other

relationships

Companies often fail to achieve the value they had expected a relationship to

yield. Many times, organisations realise only in retrospect that the foundation

of a particular relationship was never solid – because at the inception of the

agreement, planning was lacking and incentives for success were not built into

the agreement.

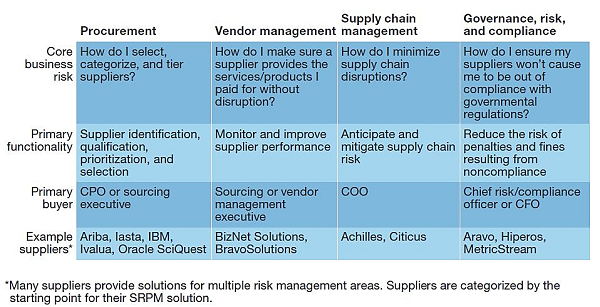

The figure below represents a typical supplier risk and relationship management

matrix.

To

successfully address the broad range of third-party relationship risks,

businesses must be competent and skilful when identifying, analysing, and

assessing risk, and then developing risk strategies and metrics. These efforts

can be complicated by a variety of factors, both internal and external.

Internal challenges:

Ownership of risk

responsibilities

Clearly establishing ownership of third-party relationship risks presents a

significant challenge to most businesses. Multiple layers of ownership often

exist, so it might not be clear who has responsibility for the third-party risk

management framework for the entire organisation and who has responsibility for

the review and ongoing monitoring of individual relationships.

Reactive approach to

risk management

In most organisations, adequate risk management involving third-party

relationships is not addressed until a problem has already arisen. By that

time, risk exposure has increased and the opportunity to mitigate is

diminished. A proactive risk assessment of the relationship at the time it is

established, and periodically throughout the course of the relationship, is

thus key.

Traditional metrics that

don’t include risk

The supplier scorecards that are often used for vendor selection and to reward

procurement teams typically focus on metrics related to quality, cost, and

delivery, but give little consideration to relationship risk including the

likelihood and associated potential cost of adverse events. The metrics also

don’t take into account the cost of monitoring and managing the risks.

External Challenges:

Complex, global supply

chains

One effect of globalisation has been a dramatic increase in the complexity of

identifying and assessing risks. Assessing and auditing compliance in remote

relationships, however, can be costly and complex. Contemporary highly

integrated supply, value, and information chains further complicate risk

assessment. Traditional ways of evaluating and mitigating risk are often

inadequate in an environment of shortened product life cycles, fragmentation of

the supply chain, just-in-time inventory practices, and other business tools that

were once considered exotic but today are the norm.

New disclosure

expectations that increase exposure to reputational risk

Today’s businesses are expected to disclose a much broader range of

nonfinancial information to demonstrate their compliance with various

environment, labour, security, privacy, and social standards. Because these

disclosures are often highly dependent on the assertions and reports of

third-party service providers, suppliers, and partners, the means for verifying

the accuracy of third-party data can be extremely limited. Most organisations

do not adequately address risk management involving third-party relationships

until a problem has already arisen.

Complex invoicing

Supplier relationships that are sensitive to prices of commodities such as raw

materials and fuel often involve complex methods of invoicing. In such

instances, prices are often pegged to a market index or other third-party

standard, which adds another layer of complexity to monitoring and contract

compliance activities. Moreover, any hedging tools must be designed carefully

to take such variations into account.

Developing and implementing an organisational supplier risk management

programme, and working effectively to manage risks associated with third-party

relationships, will ensure reduction in costs, effectual management of risk,

focus on core capabilities, and an increase in innovative supplier solutions.

Contributed by: Andrew

Hillman,

Chief Executive Officer of Bespoke Group and Publishing Editor of Bespoke

Procurement Bulletin

Article first appeared in Bespoke Procurement Bulletin:

www.bespokesourcing.co.za/articles/178839-third-party-risk-management-cause-for-concern-by-andrew-hillman