Each year the supplychainforesight report tracks the objectives and constraints in South African businesses and supply chains. By focusing on strategic business and supply chain planning over the medium term, we are able to gain an accurate view of market conditions as well as opportunities and challenges businesses expect to encounter.

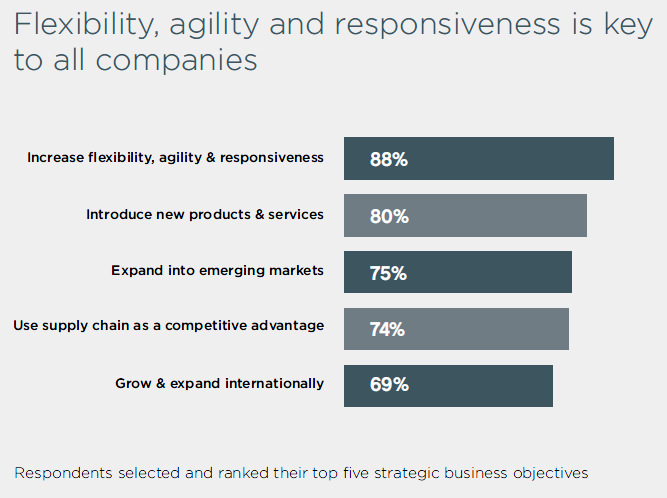

The top strategic business objective for all respondents to increase the flexibility, agility and responsiveness of their businesses is indicative of the times in which we live. It is directly linked to the top strategic supply chain objective, indicating the importance of integrating and harnessing the supply chain to enable business objectives.

Eighty per cent of respondents selected to introduce new products and services as their second top priority. This covers expanding into emerging markets by introducing your products and services for the first time, or creating new and customised services to grow locally and internationally.

This may partly be driven by companies looking to mitigate the increasing risk, uncertainty and competition in our local environment. Survey responses clearly indicate that emerging markets are seen as key to growth with the opportunity to expand and broaden their revenue streams. With broader market reach and greater consumer demand for customised products and services, organisations are under pressure to be flexible, agile and equipped to react to fast changing consumer demands and market conditions. This has resulted in the supply chain evolving from a means of controlling cost to using it as an engine for growth.

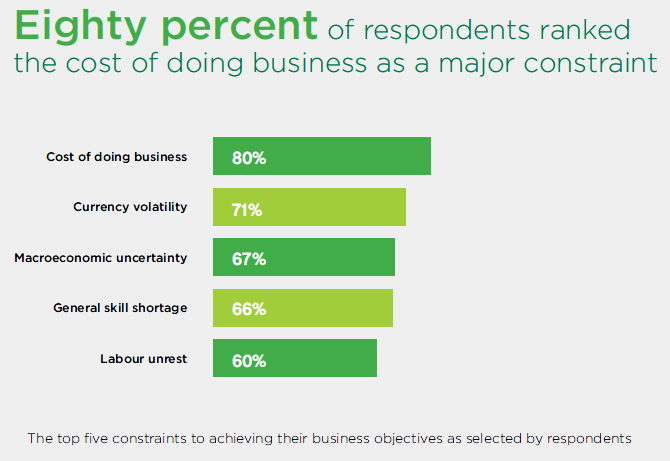

The cost of doing business is a challenge globally and one of the driving forces behind globalisation, particularly from the supply chain side.

The cost of doing business is only relevant if competitors are not subject to the same cost components and structures and if prices affect demand for the products or services. Organisations that have best managed these constraints thrive and prosper by creating flexible, agile and optimised supply chains that enable strategic cost and service differentiation.

Volatility of any kind is challenging and often creates greater opportunities for those best equipped to handle changes. Hence the link to objectives where agility and flexibility are key to managing volatility. This South African climate of unpredictability, currency volatility, macroeconomic uncertainty, labour unrest and skills shortages reinforces the need for an integrated business and supply chain strategy that is flexible and innovative, enabling businesses to adapt and continue to deliver relevant products and services to customers.

Improving service levels to customers is the top ranking supply chain objective for all respondents across all sectors.

This is an indication of how businesses are being forced to focus on keeping their customers happy. In this context, improving service levels to customers covers everything from increasing visibility across the supply chain to improving systems and processes so that the right product in the right quantity and condition is delivered to the right customer in the right time, at the right place and right price.

With the shift from the age of information to the age of foresight, an increasing number of business leaders are realising the value of analysing and interpreting information and converting it into business intelligence. Improved business intelligence is enabling businesses to really understand what their customers’ needs and wants are, which in turn creates the opportunity to develop smart partnerships that are geared to continually satisfy and retain customers.

This would explain businesses’ stronger focus on the dissemination of intelligence along with improved communication and collaboration across the value chain. All of which highlights the point that businesses recognise that knowing your customers is key to creating a competitive advantage.

The top two constraints; cost of transport and available supply chain skills, are again world-wide phenomena, and indicate areas where innovation and smart solutions will have their biggest impact.

From a South African perspective, many of these supply chain constraints appear to be greater than for other competing nations that supply our local market and other targeted international markets. This does raise the issue of managing what you can manage and innovating to create other advantages that will offset constraints over which organisations have little influence.

Although labour unrest and the ability of our ports and harbours to facilitate importing and exporting goods efficiently are beyond businesses control, they do highlight the need for a variety of innovative supply chain solutions that create flexibility, agility and responsiveness. Finding different ways around such constraints is critical for achieving objectives.

Environmental sustainability is a growing megatrend that is not only driving product and service innovation but innovation through the formation of smart partnerships that address skills and capabilities and enable more innovative solutions. But only companies that see this as a competitive advantage or cost benefit appear to be focusing on green initiatives.

To download the complete report, please visit http://www.barloworld-logistics.com/site/industry-insight/