This story is about how a company entered with a new product into a market with an existing dominant supplier. The journey has only just started, but looking back at the first few steps, it was not brand against brand that gave the breakthrough, but supply chain against supply chain [1]. The product I am talking about is a high capital value, long service life, Continuous Miner used in underground coal mining operations. The opportunities and challenges we faced apply to any mining machinery supply chain.

Some needed background

In coal mining operations, as long as the coal is flowing, everyone’s happy. However if a breakdown interrupts production and is prolonged by a supply chain deficiency, all hell breaks loose. The machine that this article revolves around is critical in the production of underground coal, so as a supplier, we need a perfect supply chain to have an equally satisfied customer. There is just one way to build credibility and trust and that is to have every link in the supply chain holistically integrated and smooth flowing with all the pressures associated with customer demand [2].

During the testing of the first prototype, the supply chain was fairly simple, consisting mainly of critical spares stored at the mine test site and trained field service engineers 24 hours at the machine. Rectifying problems immediately and giving regular feedback to the customer resulted in building strong customer relationships [1]. It was an efficient supply chain with information flowing freely between the design team, critical suppliers and the customer over the trial period of just more than a year.

Lessons learnt were included in the 1st production model that was sold to an early adopter customer. Confidence in our supply chain to support the product is an order winner. After all, this is German quality and not much can go wrong. They are perfectionists who think about everything. He was proven right as we had more spares than was required and with every breakdown we had a spare to keep the machine going.

In the next three years, we sold seven more machines and become the fastest growing new entrant into the market. The first machines were coming back for rebuilds and the supply chain was pulled into a new level of complexity with local and global challenges. The supply chain needed to be aligned with the business strategy [3].

Supply Chain Development

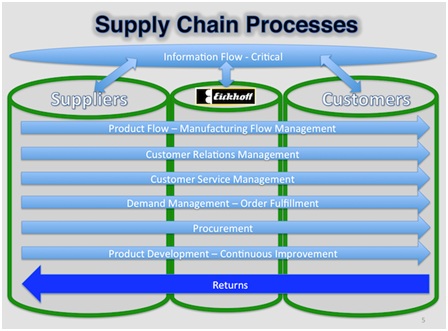

We quickly had to learn that the supply chain is a network of organizations that are involved, through upstream and downstream linkages, in the different processes and activities that produce value in the form of products and services in the hands of the customer [2]. The supply chain expands from the source of supply, the raw materials, to the point of consumption, the end user (end-to-end, dirt-to-dirt) [2]. Managing the supply chain is the integration of the seven key business processes and the intricate network of business relationships [1][4]. The key supply chain processes are customer relationship management, customer service management, demand management, order fulfillment, manufacturing flow management, procurement, and product development and commercialization. All processes span from the lowest tier supplier to the highest end-customer [1]. The returns need to be equally managed, the 8th key process that had to be learned the hard way.

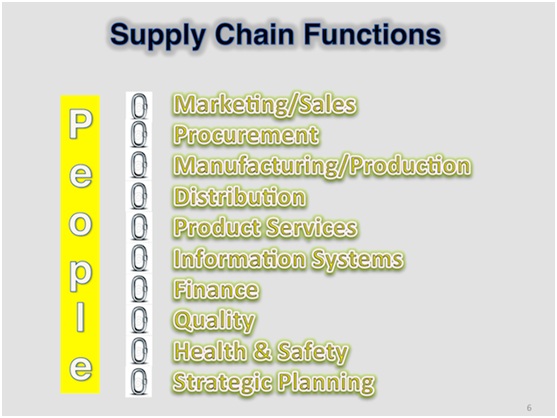

Having developed an understanding of the supply chain structure consisting of tiers of suppliers on our left and levels of customers on the right (see figure above) and the processes that are the activities that produce the value, we needed to identify the functions (see figure below) that would make the supply chain come alive [1][2]. We had to find the best people for each function, key to our success in supply chain development.

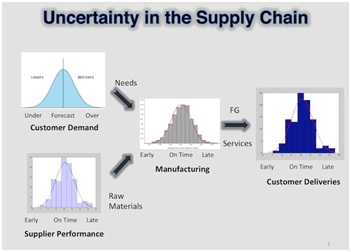

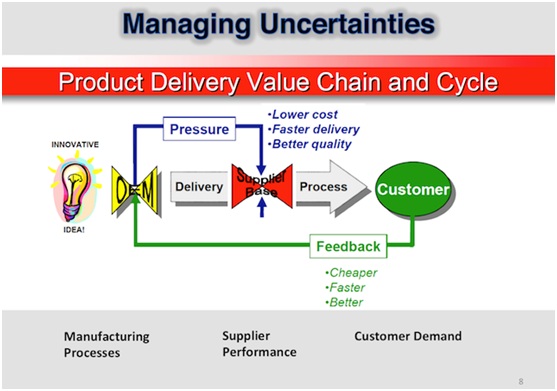

As a new entrant, we were faced with some real uncertainties in the supply chain. How can we ensure adoption into the major mining houses? A demand driven production strategy may not work. We achieved market entrance by having product available when needed together with over inventory to ensure optimized after sales support. We over-invested in inventory to compensate for uncertainty. The areas of uncertainties, each with its understanding of relative impact on the supply chain, are shown below [5]. The management of the uncertainties remains a never-ending challenge (see figure below) [6]. The customers demand cheaper, faster, better products and services from us as the OEM. This puts pressure on the delivery process and the complete chain of suppliers.

With the ever-increasing inventory levels, there was a desperate need for cost reduction through supply chain optimization. In the mining industry, customer demand variability will always remain a fact of life, so reducing customer demand uncertainty is deemed impossible. If they want it now, they want it now. You either have it or you don’t. We started to realize that real time information flow throughout the supply chain would be key to achieving the cost reduction objective. So we implemented an enterprise resource planning (ERP) system that integrates all the information into a single application giving us up-to-date information where needed [7]. We now had the ability to integrate via the Internet with all our global suppliers and local customers [7].

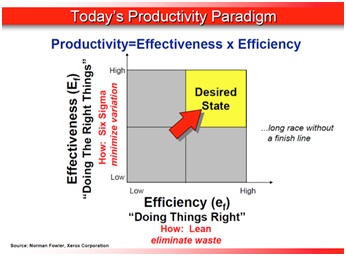

To improve on lead times, we needed a paradigm shift in productivity. We needed to do the right things (effectiveness) the right way (efficiency) [6], see figure below. We had top management commitment on this lifelong journey of continuous improvement by implementing methodologies such as lean manufacturing, lean services, Six Sigma, Kazan, just-in-time, BOM (Bill of Materials), MRP (Materials Resource Planning) with the aid of tools such as SAP [8]. We had to move away from the initial costly global sourcing of all parts and machines from our main factory in Germany to local manufacturing and procurement to reduce supply chain costs. It added the benefits of reduced lead times, flexibility and speed [6].

Supply Chain Opportunities and Challenges

The need for coal in the next few decades confirms the need for mining machines. A new generation of decision makers is emerging in South African mining that are less brand conscious. The split between competitors will be determined by who can satisfy the customer needs best based on life cycle costs and trust in the supply chain [9]. The product age has come to an end. Products wrapped in services are what will produce sustainable revenue and profit for businesses in the mining industry [6]. The global need for talent is draining experienced skilled people out of South African mining [10]. Then, there is the global commitment towards green products and supply chains, socio economic development and equality for the better good of all [11].

So, our business strategy included the development of products that are modular and energy efficient, utilizing globally standardized components. It called for the selection of the best suppliers and building long-term transparent relationships with our strategic suppliers. We wanted demand driven production with lead times that are attractive to our customers and shorter than any of our competitors [12]. The main objective was to increase service levels to customers [13].

The business strategy required the supply chain to be flexible to adapt to flexible production schedules, available infrastructure, and demand variation [3]. It needs to be as insensitive as possible to skill levels, exchange rate variations, customs delays, taxes and duties, and transport and delivery variations, and infrastructure [12].

For us here in South Africa, the most important challenges were supply chain cost containment, information transparency and flow (visibility), end-to-end integration, methods to increase responsiveness, global sourcing and supplier relationship management whilst protecting intellectual property, and cultural issues [14][15].

The supply chain that has the competitive advantage takes a holistic view to end-to-end integration of all transactions, provides visibility to all and has the commitment from the leaders at the top who have the vision and strategy to set the agenda for change for what the company will become [14].

Contributed by Jahn Reinhart, Managing Director, Eickhoff

References:

[1] Douglas M. Lambert, Martha C. Cooper. 2000. Issues in Supply Chain Management. https://regent.blackboard.com/bbcswebdav/pid-3433175-dt-content-rid-322578_4/xid-322578_4 Accessed 12 August 2012.

[2] Martha C. Cooper, Douglas M. Lambert and Janus D. Pagh. 1997. Supply Chain Management; More than a new name for Logistics. https://regent.blackboard.com/bbcswebdav/pid-3433175-dt-content-rid-322577_4/xid-322577_4 Accessed 12 August 2012.

[3] Barloworld Logistics. 2012 supply chain foresight – South Africa Inc.: Growth, Competitiveness and the Africa Question. http://www.barloworld-logistics.com/industry-insight/ Accessed 11 November 2012.

[4] Ram Ganeshan and Terry P. Harrison. 28 September 2002. An Introduction to Supply Chain Management. http://mason.wm.edu/faculty/ganeshan_r/documents/intro_supply_chain.pdf Accessed 12 August 2012.

[5] Tom Davies. 1993. Effective Supply Chain Management. http://0-search.proquest.com.library.regent.edu/docview/224965036 Accessed 12 August 2012.

[6] G.H. Associates. January 22, 2004. Optimizing the Supply Chain: Gaining Competitive Advantage through Supply Chain Management. http://www.polymerplace.com/articles/Online-%20presentation-Supply%20Chain.pdf Accessed 9 November 2012.

[7] Thomas Wailgum and Ben Worthen. November 20, 2008. Supply Chain Management Definition and Solutions. http://www.cio.com/article/40940/Supply_Chain_Management_Definition_and_Solutions Accessed 12 August 2012.

[8] Beth Shirley. 29 May 2009. IT System to enhance supply chain management for mines. http://www.miningweekly.com/article/it-system-to-enhance-supply-chain-management-for-mines-2009-05-29 Accessed 11 November 2012.

[9] Supply Chain Update. 16 May 2012. Supply Chan Management – a World of Opportunity. http://www.supplychainupdate.co.za/Article.aspx?ID=90 Accessed 10 November 2012.

[10] Supply Chain Update. 23 October 2012. Talent Management is Key to a Smoother Running Supply Chain. http://www.supplychainupdate.co.za/Article.aspx?ID=138 Accessed 10 November 2012.

[11] CSIR, University of Stellenbosch, Imperial Logistics. April 2012. 8th Annual State of Logistics Survey for South Africa – 2011. Gearing up for Change. http://www.csir.co.za/sol/docs/8th%20SoL%202011_23May2012.pdf Accessed 9 November 2012.

[12] Barloworld Logistics. Supply Chain Foresight - Mining Report - 2009. http://www.barloworld-logistics.com/industry-insight/ Accessed 11 November 2012.

[13] Barloworld Logistics. 2011 supply chain foresight – Evolving Startegies, Competitive Supply Chains in Emerging Economies. http://www.barloworld-logistics.com/industry-insight/ Accessed 11 November 2012.

[14] Dirk Claessens. IBM. April 2009. The Smarter Supply Chain of the Future. http://www-05.ibm.com/de/processindustry/pdfs/cscostudy-metal-en.pdf Accessed 11 November 2012.

[15] Supply Chain Update. 28 May 2012. South Africa Logistics must Gear Up to become Global Partner. http://www.supplychainupdate.co.za/Article.aspx?ID=103 Accessed 10 November 2012.