The broad array of risk-related challenges that businesses face today makes it clear that an uncoordinated or case-by-case approach to third-party risk management is no longer adequate. At a practical level, a successful third-party risk management program is typically implemented in three steps, as follows:

1. Establish

ownership and buy-in.

Planning

for change is critical to successful third-party risk management in organisations

where the ownership of such risk is dispersed among multiple stakeholders and

owners. This planning requires cross-functional coordination, executive

leadership and oversight, and clear goals and objectives. The mission of most

organisations often includes a focus on strengthening the overall relationship

with the third party.

Success

factors:

·

Clearly

establish risk ownership

·

Obtain

cross-functional input from various stakeholders

· Develop a third-party risk management road map

2. Evaluate risks

Understanding

the risk profile of the entire organisation helps focus efforts on the areas of

highest risk, which allows the assignment of adequate resources to address

specific clauses in an agreement or specific types of relationships or

categories of risk. Developing a comprehensive risk landscape is often a

helpful first step in evaluating the various risks in a relationship. This step

helps avoid taking a one-size-fits-all approach and instead drives focus on the

areas of risk and reward to the organisation.

Success

factors:

·

Identify

the high risks inherent in the third-party relationships

·

Quantify

identified risks

· Establish a plan for moving forward

3. Audit, monitor,

and assess

The

risk landscape spurs initiatives to audit, inspect, benchmark performance and

costs, verify, and gain assurance or attestation. A successful third-party risk

management program has an appropriate level of:

·

risk

measurement and monitoring

·

performance

measurement and monitoring

·

incident

tracking

·

evaluation

of the value received from the relationship

These

activities are important for determining when or whether to renegotiate the

terms of an agreement. The companies that are most successful in this auditing

and monitoring function are those that work to enhance the data they have about

their relationships so that they can predict areas of risk more accurately and

automate relationship monitoring more effectively.

Success

factors:

·

Customise

the assessment to the relationship

·

Use

automation to streamline the process

·

Analyse

trends of incidents across relationships

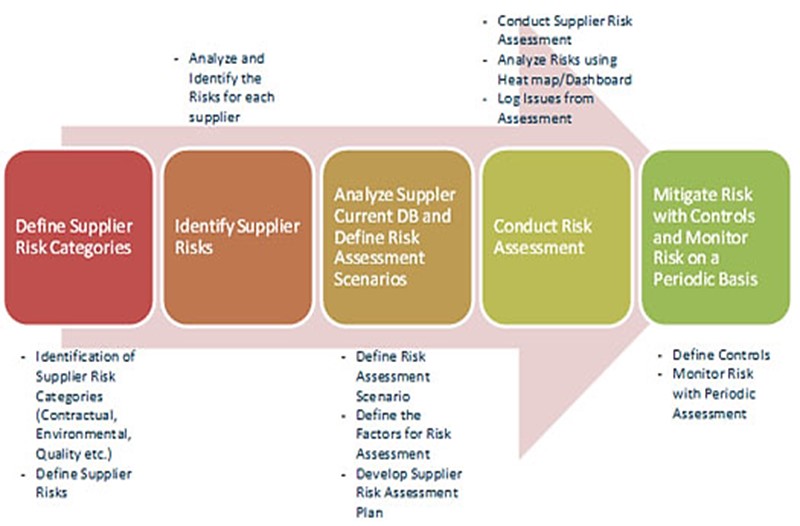

The figure below details the process that should be followed for the effective management of supplier risk and compliance, using the same approach described above:

Engaging executive

management

As

already stated, third-party risk planning requires cross-functional

coordination, executive leadership and oversight.

The

following are some questions related to third-party risks that CPOs, executive

management and board members should consider:

·

Does

our company have a full inventory of its relationships and agreements?

·

Have

we performed an assessment of the risks to the business or the brand for each

of the relationships we have?

·

Who

owns the assessment of risks?

·

What

are the key relationship risks and processes in place to manage them? Who is

responsible for risk management and monitoring?

·

How

do we know that our relationships are complying with the agreements in place?

·

What

are the company policies related to auditing agreements for compliance?

·

How

do we know our relationships are complying with laws and regulations?

·

Which

of our key relationship agreements or statements of work have not been reviewed

by legal counsel in the past three to five years?

·

What

procedures do we follow to reassess the risks associated with a relationship

prior to the renewal of a contract?

·

What

types of risks are considered in the selection or renewal process?

·

Are

any significant risks not considered?

·

Do

our standard agreements address the key risks of most relationships?

·

How

do we know the reports we rely on from our third-party vendors are accurate?

·

Have

we tested our business continuity plans with our principal third-party

relationships?

·

How

dependent are our third parties on subcontractors and subservices?

·

What

risks are associated with these organisations?

Of course, not all supply chain failures can be avoided, but efforts need to be made to identify supply chain risks and recognise early indicators of failure so that their impact to the business can be mitigated.

The most effective and proven practices for managing supply chain risk is to pre-qualify suppliers properly, measure supplier performance and engage in effective evaluation and audit with suppliers to proactively address any supply chain risks.

Contributed by: Andrew

Hillman, Chief Executive Officer of Bespoke Group and Publishing Editor of

Bespoke Procurement Bulletin