The

majority of companies today rely heavily on suppliers and contractors for the

provision of goods and services as well as outsourcing parts of their supply

chain. Suppliers are spread across regions, continents and the globe, crossing

cultural and language divides. Many companies have limited and antiquated

knowledge of their suppliers and the environments in which they operate. This

limited and outdated knowledge acutely affects these companies’ ability to

successfully manage the dynamics of their supply chain, which has introduced

substantially more risk in business.

The global financial crisis, recent natural disasters, fluctuating commodity

prices, exchange-rate volatility, lean-business practices, bribery and

corruption (coupled with South Africa’s unique regulatory environment and the

Mining Industry Charter) has added complexity to the management of supplier

risk.

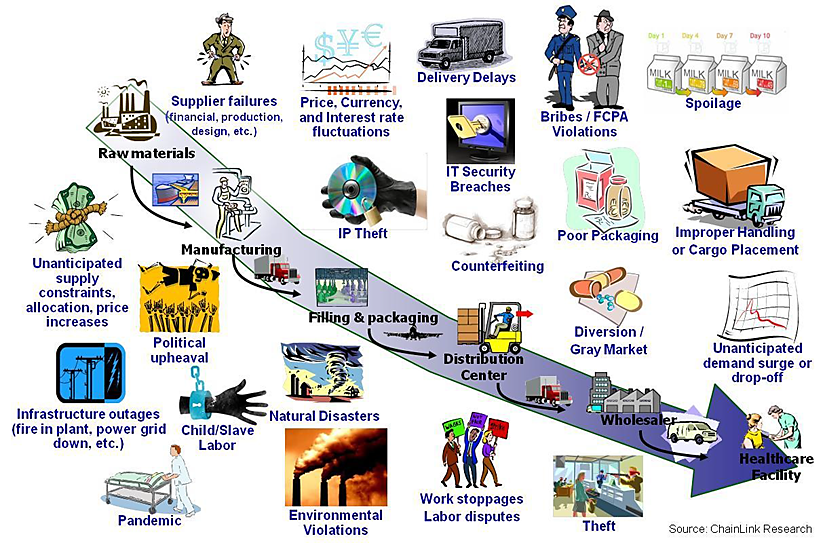

The range of supply chain risks extends far beyond just the financial stability

of suppliers, as shown in the figure below.

Figure 1: Range of Supply Chain & Supplier Risks

With increased regulatory scrutiny, continuing cost pressures, active

investors, and a vigilant public, businesses today must have a clear

understanding of the risks that are inherent in external business relationships.

By recognising and proactively addressing these third-party issues, business

leaders can reduce exposure to risk and achieve stronger relationships with

service providers, suppliers and delivery partners. The end result is a

nimbler, more responsive, and more profitable operation.

In South Africa, over the past 20 years, the regulatory and legal

responsibilities have increased significantly with the introduction of new

statutes, charters, codes of practice and guidelines. The minimum requirement

for suppliers to be able to conduct business today includes, to name a few: a

valid original BB-BEE certificate, valid original Tax Clearance Certificate,

COID Certificate, proof of UIF registration and proof of Company Registration.

The evolution of statutes passed by the South Africa Parliament since 1994 is

shown in the figure below.

According The GIBS Guide to Sustainability 2012, responsible and ethical Corporate Social Investment is increasingly relevant both globally and in South Africa, where the impact of the King Codes (King Report on Corporate Governance) is particularly significant. The King Reports I, II and III urge companies toward embracing the triple-bottom-line as a business imperative; balancing social responsibility with shareholder return. It’s a delicate balancing act, where corporate reputation is critically important.

For those companies on the wrong side of corporate governance the reputational

risks are plentiful and the effects of bad press can linger for years. In 1996,

sports brand Nike was publicly accused of using child labour in its offshore

factories. This criticism continued until 1998 and only abated after the

company announced long-term measures to improve conditions.

Nike is not the only one to suffer. The recent oil spill disaster in the Gulf

of Mexico involving British oil company BP is another example, as is

Coca-Cola’s overexploitation of scarce water resources in India, or criticism

of Nestlé for selling baby milk powder in countries without reliable access to

clean water.

The following questions should be considered regarding your corporate

reputation risks:

• Can your reputation and brand tolerate being connected to your suppliers’

ethical and compliance mishaps?

• Are you confident about the ethics and compliance of your suppliers’

suppliers?

• Are your suppliers prepared for conflict minerals regulations?

• Is your supply chain prepared for a government coup?

• What happens to your supply chain if one of your suppliers can’t ship their

product due to a natural disaster?

• Do you know if your second tier (and beyond) suppliers follow the sustainable

initiatives that your organisation promotes?

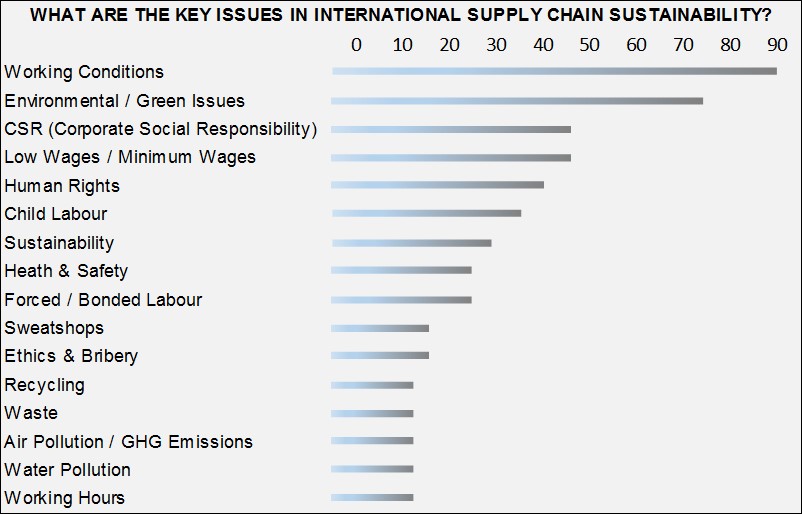

Companies should be mindful of the key issues and areas of concern related to

sustainability along their supply chain, as shown in the figure below.

Figure 3: Managing

Sustainable Global Supply Chains: Framework and Best Practices (Source: GIBS)

As a result of the global nature of the economy, and the complexity of business

relationships, businesses’ risk-management efforts must be more comprehensive

than ever. The risks that require monitoring and managing range from financial,

operational, legal, and regulatory concerns to environmental, reputational, and

technology related risks.

Organisations must have a clear understanding of the risks inherent in their

business relationships with outside parties. To address these risks, companies

must implement programmes using non-adversarial third-party risk management

strategies that benefit all parties.

Contributed by: Andrew Hillman is Managing Director of Bespoke and Publishing Editor of Bespoke Procurement Bulletin

Article first appeared in Bespoke Procurement Bulletin: