To make the most of service level agreements (SLAs), you need to implement three key steps. These entail establishing a comprehensive strategic sourcing intervention; meeting the critical success factors for a proper governing contract document, and then – naturally – continuous post-implementation measurement.

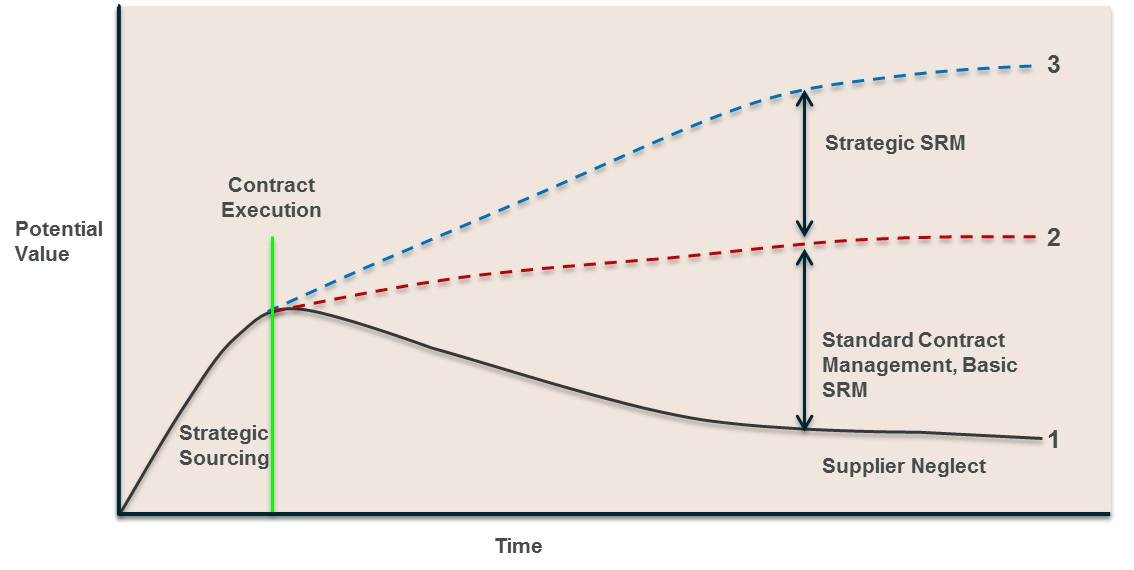

The illustration above is widely recognised in the procurement fraternity. It demonstrates the benefits of effective supplier relationship management (SRM) to an organisation. Furthermore, it illustrates the need to maintain and continue to seek future potential benefit should SRM be effectively executed, as well as the potential consequences should it not. Equating the trendline to a timeline, it points out at least two periods critical to effective SRM in the evolution, specifically contract execution and strategic sourcing. These two events (or periods) are most essential in securing the benefits of effective SRM.

Ideally,

the rights, duties, obligations and necessary legal requirements are contained

in one neat, concise and condense document that is the contract. It is the

product of both common and substantive law, and seeks to hold the contracting

parties to the attainment of their respective (internal) objectives. For the

procurement professional, it forms the basis of contract management. And for

the individual tasked with SRM, it forms the basis of his objective, namely the

extraction of any and all future potential value. The point on the timeline is

the actual, final signed document (“0 BC” or “zero before contract”) following

a period of consultation and negotiation. However, neither this point nor its

preceding period exists in isolation: both are dependent on the process of

strategic sourcing.

Effective strategic

sourcing

Strategic sourcing lies before contract on the timeline. Its duration varies in

line with the complexity of the procurement intervention, starting with the

first date of the intervention in the organisation towards unlocking value. As

evolution drives progressive development, so with strategic sourcing. It is a

formal approach that results in the optimal selection of supplier(s) and

alignment of the supply chain to deliver best value to the organisation and its

requirements. The strategic sourcing process is reproducible, analytical, and

leads to an increase in value - either by reducing total cost or increasing the

service and quality provided.

So as demonstrated, strategic sourcing is a process and consists of many

critical and essential steps. It is also the period wherein the greatest value

is delivered in the shortest period of time. Its fundamental origin lies in

data analysis. This too is a small evolutionary process consisting of data

extraction, inspection and interpretation, verification, cleansing, transforming

and modelling with the goal of finding useful information, making conclusions

and supporting decision making. The supporting information is commonly found in

the spend patterns of an organisation – no matter how poor the recordkeeping or

(ERP, purchasing, payment or financial) systems of the organisation may be. Of

course, the poorer the systems, the longer this process takes. Once

successfully completed, however, it points towards the correct interested

persons (the stakeholders) and enables effective commodity classification.

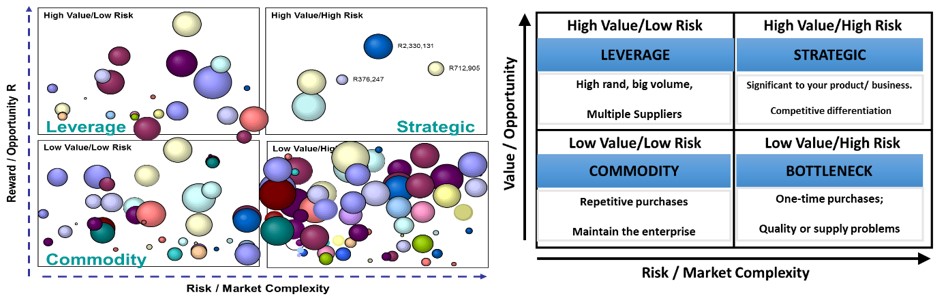

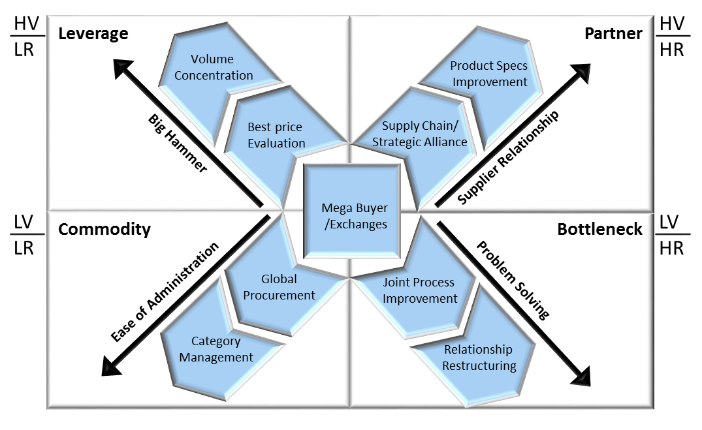

The

duly-populated Kraljic Model is the first graphical representation of the ‘Big

Bang moment’ in a procurement intervention (Fig.1). It is founded on the

correct plotting of the commodities into appropriate quadrants based on “reward/opportunity”

and “risk/market complexity” axes. Each quadrant has its own unique

characteristics and ‘objective’ (fig.2) and corresponding ‘strategy’ (fig.3):

Once

commodities (or commodity categories) are correctly allocated to a quadrant,

the selection of the appropriate strategy which is aligned to the particular

objective is pivotal. It indicates the particular evolutionary route the

specific procurement intervention is going to follow.

A further critical step in the strategic sourcing process is to determine the

appropriate supplier(s) in the case of goods /service provider(s) in the case

of services. The following tools, exercises and matrices are available:

Vendor

pre-qualifications questionnaire (PQQ): the PQQ aims to

ascertain, with some degree of accuracy, the suppliers’ capabilities to deliver

the requirement effectively. It can reveal supplier compliance to financial,

safety, legislative and other requirements (e.g. BBBEE and commitment to

transformation in the South African context). Cognisance is also taken of

vendor reputation;

Supplier

positioning using ‘Porter’s five forces: Thorough market analysis will

determine;

- Number of suppliers;

- Number of goods/services including alternatives; and

- Number of buyers/users of the goods or services

Supplier risk: the

need for effective risk analysis cannot be sufficiently stressed. The ‘STEEPLE’

-analysis is one such tool. The inherent risk has a direct relation to cost as

it materially influences the contract document that will govern the

relationship and the effect it will have on costs. There are predominantly four

risk strategies: ‘terminate’, ‘treat’, ‘transfer’ or ‘tolerate’. Should the

risk strategy be one of risk transfer, costs from the supplier/service provider

will inevitably increase. Think for example of extended warranties for services

delivered or payment retentions, stockholding regimes (e.g. Consignment Stock

or VMI/VOI) and payment terms (30 days, 60 days, etc).

Critical success factors

Following the finalisation of a comprehensive strategic sourcing process (step

one), the critical success factors for drafting the governing contract document

(step two) are:

• clearly defined expected benefits (objective and strategy are met)

• co-operative and capable service providers (market analysis);

• risk mitigation (risk analysis and adopted risk strategy is evident);

• demonstrable deliverables with corresponding measurement matrices and

appropriate sanction/benefit for attainment/non-attainment.

Clearly defined demonstratable deliverables, though a component of step two, is

the foundation on which step three for effective SLAs, namely measurement, are

built and is a condictio sine qua non (causation factor) for effective

post-implementation contract managements (and the forerunner to effective SRM).

It entails the proper formulation of the SLA objectives, using industry

recognised matrices, e.g. “SERVQUAL”. The particular service will dictate the

extent of the measurement requirement and its appropriate importance/weighing.

Clearly defined key performance areas (KPA) encapsulates the objectives of the

SLA and is supported by clearly defined key performance indicators (KPI). The

latter conforms to the SMART approach (specific, measurable, attainable,

relevant, and time-bound) and are objectively determined to indicate attainment

of the particular KPA.

Contributed by: Xavier

Greyling,

a Senior Associate at Bespoke, an attorney and an MCIPS-accredited procurement

and commercial strategist with over 15 years’ experience across the spectrum of

procurement and supply chain

Article

originally appeared in: