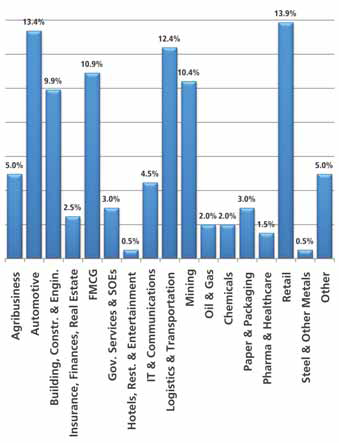

The supplychainforesight research report into attitudes, issues and trends in South Africa’s supply chains has been conducted under the auspices of Barloworld Logistics since 2002 and is now well-established as the benchmark qualitative study of the national supply chain. This year’s ninth edition of the report goes by the title South Africa Inc.: Growth, Competitiveness and the Africa Question. Once more it samples the responses of a wide range of senior executives and decision makers from across most of South Africa’s industry sectors, and not only those involved directly with supply chains. A wide range of businesses of different sizes are also canvassed each year, with a concentration on large multinational companies.

Clearly the most burning question facing South Africa’s businesses, across all industry sectors, is how to use their supply chains to remain profitable and competitive in a world stricken by economic slowdown, rising unemployment and high levels of debt. In South Africa these efforts to deploy the supply chain as an enabler of growth have been hampered by labour costs, bureaucracy, infrastructure shortcomings and other competitive challenges.

One of the aims of this year’s research, therefore, is to gauge how individual companies and industries are engaging the changing economic landscape with which the country is faced. In particular that landscape reflects a shift in global economic power, away from the developed world and towards the still growing economies of the major emerging markets, which has been evident for the last few years. This shift should present South African business with a major opportunity to capture market share and grow. Companies and industries should be embracing emerging market economies as trading partners and as new markets – and this is especially so of the African continent, where South Africa has for so long been seen as the trading and logistics gateway into Africa – a position which is now under threat.

This year’s supplychainforesight study therefore sets out to analyse where South African companies are in terms of their strategies for growth, and engaging with how they are building and being part of a supply chain that is extending across their industry sectors and ultimately across the national economy. This includes looking at how South African companies are organised and represented in their industries, and what industry-wide initiatives exist for key areas such as industry lobbying and skills training.

The survey probes the objectives, challenges and constraints that face businesses, industries and the country in the quest for growth in difficult circumstances. Part of this focus on future insight – or foresight – is the implications of the shift to emerging economy markets and in particular looking to other African markets as a new field of possibility.

Given this context, the study is organised into three key sections:

· Firstly, a more comprehensive view than in previous years on both business and supply chain short term and medium term objectives and constraints on South African companies.

· Secondly, a section on South Africa Inc., and the competitiveness both of individual companies and the industries they are in. This will provide us with a clearer picture of the threats and opportunities faced by South Africa as a nation competing in global supply chains with other nations. This section includes questions on industry competitiveness in an international landscape, how industries are organised and represent themselves to other industry sectors and to Government, and what are their growth prospects given our current infrastructure constraints.

· Finally, we take these industry growth and competitiveness issues into the international fold by asking where the threats and opportunities lie for South African industries and the national supply chain, in particular in other African markets. The respondent and company profile for this year’s study follows a similar pattern to our established base.

Well over 50% of the respondents are in senior executive positions across their businesses, including CEOs, MDs, Marketing Directors and Financial Directors. A substantial percentage come from supply chain and logistics senior management. Similarly, these senior executives come largely from multinational businesses of considerable size – over one third come from businesses with annual revenues of over R5bn, and more than half of over R1bn.

Part One: Business and Supply Chain Objectives and Constraints

Our approach to the trend-tracking part of the study is changed this year by the need to measure what companies feel are the major constraints to growth. Instead of looking at challenges, which was our past approach, we asked for both general business and specific supply chain constraints to go along with business and supply chain objectives over a medium term framework. The reason for this is to explicitly link strategic business objectives and constraints to supply chain strategies, to gain a better picture of what needs to be done in the supply chain arena to better underpin and enable the growth ambitions of business.

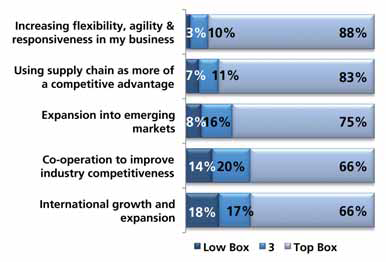

Top 5 Strategic Business Objectives:

The top option chosen for the medium term business objective is to increase flexibility, agility and responsiveness, followed closely by the goal to use the supply chain as more of a competitive advantage. These two are closely interlinked, and demonstrate the closer alignment of business and supply chain strategy over the last few years. The objective for the business to adapt flexibly and quickly to variable customer demand in a tight and volatile market is something of a breakthrough. Previously a strong focus on planning and forecasting has marked efforts to make the supply chain more competitive – but accurate forecasting remained, in past research surveys, a constant challenge. The current focus on responsiveness marks a welcome shift to more engagement with actual customer demand and market conditions rather than product and manufacturing schedules. A more positive macroeconomic outlook is evident in other top choices for business objectives being focused on growth – expansion into emerging markets and internationally. The expansion into emerging markets objective in particular is of interest – it is the third most supported objective by the respondents, with three quarters of the sample selecting it as a top objective. As we shall see later on, while there is a great deal of challenge and operational difficulty associated with moving into emerging markets, especially in the rest of Africa, emerging market expansion and growth is also being seen by South African companies as much more of a real opportunity. The need for industry-based collaboration rounds out the top five objectives – a further sign of maturing business attitudes to competitiveness.

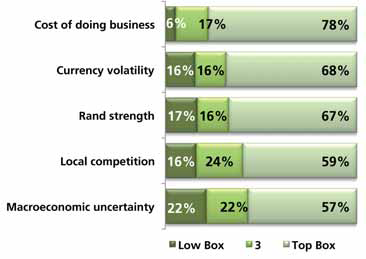

Top 5 Strategic Business Constraints:

The top constraints on the other hand demonstrate a strong focus on costs. The leading constraint for South African-based businesses is the cost of doing business, a factor made up of various contributory causes, not least of which are bureaucracy, taxes and customs costs, as well as the high costs of electricity and labour. While ‘Rand Strength’ features strongly as a constraint, it is perhaps more accurate to focus on the currency’s volatility as a business constraint, since this adds to planning uncertainty for both import and export trade, as well as for domestic production and consumption. While ‘local competition’ is listed as a constraint, this may be read as a positive – that local companies are becoming more competitive through deploying their supply chains better.

Supply Chain Objectives and Constraints

We now focus on the specifics of supply chain strategy, how it can support the business and where it is hampered.

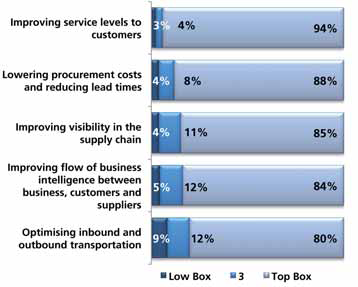

The Top 5 Supply Chain Objectives:

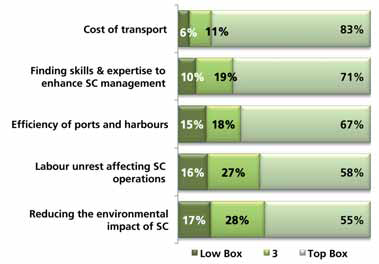

The Top 5 Constraints to Supply Chain:

In terms of supply chain objectives, strong emphasis on cost management goes alongside a realisation that partnership is essential to the use of the supply chain as a competitive advantage. Therefore, increasing service levels to customers remains the number one supply chain objective, as it has in previous years. This objective must still be achieved at the lowest possible cost, as the objective of lowering procurement costs and decreasing lead times tells us. Essentially, in a highly competitive environment of variable demand, customer needs must be met in the most cost-efficient way possible. What is interesting is a shift in perception about how this can be achieved. The next top objective is improving visibility in the supply chain, followed closely by improving the flow of information between the business, suppliers and customers. This strongly suggests a maturing of the long-held mantra of the supply chain, collaboration. No longer can suppliers be squeezed if the supply chain is to remain competitive - there has to be a more strategic and holistic view that is to the mutual benefit of supply chain players, and offers sustainable benefit to the customer in the longer term. In fact, in industries where the competitiveness of the supply chain is critical to success, such as the Automotive industry, the information flow objective is supported by every single respondent.

Regarding supply chain constraints, a more familiar picture emerges. The cost of transport features as the greatest supply chain constraint, for almost every industry sector. South Africa’s high logistics costs, and the imbalance between road and rail, have been well-documented. Sadly, this has been exacerbated lately with the imminent imposition of tolling and carbon tax fees. This is one area that desperately needs effective communication between all industry sectors, since all of them have to move goods, and the Government. Over and above the public sector/private sector disconnect, companies do need to ask themselves hard questions about reducing these costs - are they moving their goods in the most cost-effective way possible? Is each industry considering innovative ways of moving their goods differently – through co-operation with other industry sectors, for example? The bottom line is that there is enormous value to be had in businesses constantly re-looking at their transport strategies and thinking laterally about them.

The second major constraint is finding skills to enhance supply chain management. As we shall see, the skills issue remains a burning and urgent challenge for companies across all industry sectors – but can it be addressed in a different way? In the meantime, are companies partnering with the right companies to provide them with such expertise and skills, in a mutually beneficial relationship? Labour unrest, which featured prominently in the South African market and especially in the freight transport sector in the year under review, is unsurprisingly featured as a major constraint. Perhaps more surprising is the presence of ‘reducing the environmental impact of the supply chain’ as a constraint - a first appearance in the top five for this option. The increasing pressure to reduce carbon footprint and to hold suppliers accountable, set by legislation and tax regimes, undoubtedly accounts for this constraint becoming prominent. The pressure on corporations to ‘go green’ is thus now affecting the bottom line.

For the full report, please visit www.supplychainforesight.co.za